Grain Central

CANOLA prices continue to be pressured by ample global supply and low crude oil prices which are weighing on the wider global oilseeds complex, according to Lachstock Consulting June canola supply-and-demand report released on Friday.

Despite concerns over dry conditions starting to creep into EU crops and dry conditions prior to planting in western Canada, Lachstock said production estimates were still looking “pretty healthy”.

“A significant production issue in Canada or here later in the year or a big uptick in China demand are likely to be the only things that can change the current fundamentals pressuring canola prices,” the report said.

Lachstock said Brazil’s “mammoth” soybean crop has just been harvested and is estimated at 155 million tonnes (Mt), but seems to grow with each new estimate.

“Stubbornly high global inflation continues to impact demand for oils and disappointing economic data out of China means that they are not likely to be shifting the global demand needle any time soon.

“The market continues to take any Russia-Ukraine escalation in its stride and with ample EU supply heading into the new marketing year, it doesn’t seem to matter if Ukraine supply is out of the equation.”

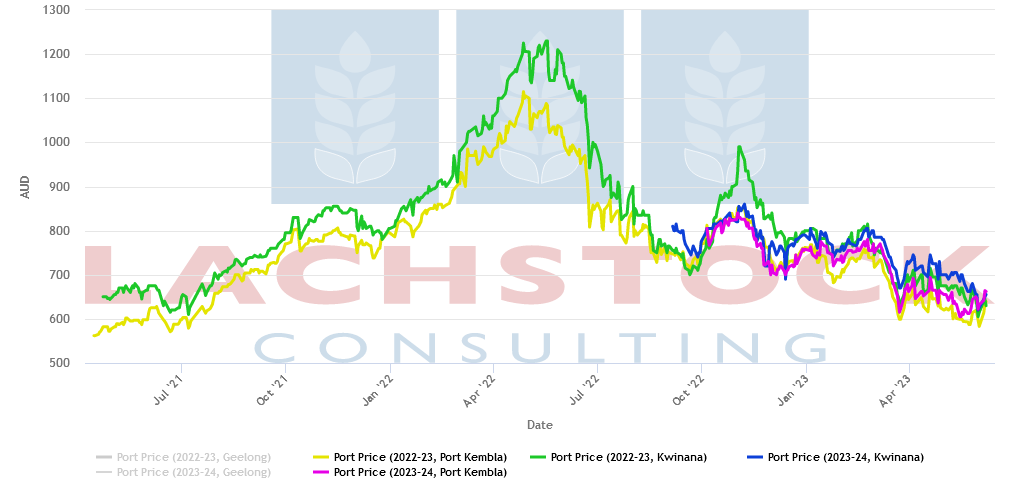

West, east values similar

Lachstock said Western Australian values were currently in the A$625-$650/t range, well below the mid-2022 highs, and roughly in line with eastern Australian values of $620-$640/t.

“Even with the cracking export pace, we will still have nearly 2Mt carry-out at the end of the current marketing year, which is adding to the weight of high carry-out globally.”

Australian Bureau of Statistics data indicates Australia exported 355,000t of canola in April, close to half the 660,000t shipped in March, but shipping stems indicate a rebound in May and June, with around 520,000t and 400,000t booked respectively.

Lachstock analysis shows that 540,000t has been exported out of NSW ports between 1 October 2022 and 30 April 2023, and a further 150,000t is on the stem for May and June combined.

“We still expect export pace to drop off after June as supply from the Northern Hemisphere becomes available and record volumes of wheat and barley, particularly out of WA and SA, compete for room on the shipping stem.”

Lachstock said the NSW current crop has been hard to gauge due to the impact of waterlogging and flooding on planted and abandoned area.

“We have had to revise NSW production up again as export pace has shown that we underestimated the size of the crop.”

While ABARES last week forecast new-crop canola production at 4.9Mt, Lachstock is sitting on 5.72Mt, 29 percent lower than last year’s crop.

“We are assuming that the area planted to canola will be down 7-15pc across the board with lower prices prior to planting, the dry outlook and the uneven autumn break all playing a part in planting decisions.

“After consecutive years of increased area planted, rotational constraints are also a limiting factor for some.”

Lachstock said the recent rainfall event has delivered patchy totals within regions.

“Those that did score decent amounts will be happy heading into winter with crops having enough moisture to establish well and will be more likely to get by on below-average winter rainfall.”

Source: Lachstock Consulting, ABARES

Source: Grain Central