Liz Wells, March 20, 2023

PRICES for faba beans, lentils, mungbeans and even chickpeas have risen in the past month, thanks to improved supply chains and healthy demand.

The month has also seen an increased ability of counterparties in destinations including Pakistan and Sri Lanka to honour contracts, which has built confidence in forward business.

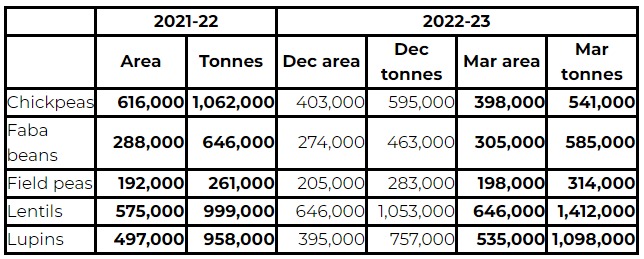

In its quarterly Australian Crop Report released March 7, ABARES has lifted its production estimates for faba beans by 26pc, field peas 11pc, lentils 34pc and lupins by 45pc from the previous figure released in December.

The chickpea estimate has been revised down 9pc.

The Australian Pulse Conference is taking place this week in Toowoomba, so keep an eye out for stories and photographs from the Grain Central team attending the event.

All prices quoted are in Australian dollars unless otherwise stated.

Table 1: ABARES hectare and tonnage estimates for the 2021-22 old crop, and the December 2022 and the revised March 2023 current-crop estimates for 2022-23 from the December 2022 and March 2023 editions of ABARES Australian Crop Report.

Chickpeas

Chickpea prices have rallied substantially in the past month, led by bulk demand from Pakistan, which is satisfied by 50,000-60,000t per month being shipped out of Pinkenba in Brisbane.

This is being supplemented by container business to South Asia amid more affordable rates and friendlier sailing schedules.

Packers on Queensland’s Darling Downs are paying around $580/t for the premium CHKP1 grade, up $30/t on the mid-February market, and $500/t for CHKPM, up at least $75/t on prices quoted last month.

Prices this high have not been seen for chickpeas since August 2021.

Australian Choice Exports managing director James Hunt said demand for volume, thanks to bulk as well as container business, is “starting to put a dent” in the tonnage of chickpeas stored on farm in Queensland and northern New South Wales.

However, most growers with chickpeas to sell are busy harvesting sorghum, and preparing to plant their winter crop and/or pick cotton, and have not prioritised the sale of chickpeas held on farm.

“There are a lot of bids and not a lot of offers,” Mr Hunt said.

Other traders have said the desi market has been rising and falling based on accumulation for cargoes going to Pakistan, where sales are being made with confidence on opened letters of credit.

Export data published last week shows tonnage shipped to Pakistan in January exceeded amounts shipped in November and December.

Faba beans

Domestic consumers are paying around $470/t delivered into the Melbourne region for faba beans, up around $20/t on last month.

In the bulk market, fabas delivered Port Adelaide are trading at around $385/t, up roughly $10 from last month.

Agri-Oz Exports managing director Francois Darcas said domestic feedmills, especially in Victoria, continue to pay higher prices for faba beans than can be found in export channels.

“The price being paid in Victoria is high enough to drag some tonnes from parts of South Australia and NSW,” Mr Darcas said.

Export pace is well below that seen in recent years, as Egypt’s ongoing foreign-exchange problems hamper its buying.

“Also, container freight is unaffordable so it’s pretty much only bulk shipments going to Egypt.”

“It’s hard to know what demand looks like over the next several months as the money problems in Egypt do not seem to be improving.”

Shipping stems indicate around 50,000t per month of faba beans are being shipped out of Adelaide, and Egypt is buying fabas in combination and full cargoes.

Lentils

Bulk lentils delivered to SA ports are trading at $800-$810/t, up from around $750/t last month.

Solid demand from Sri Lanka on the larger Nugget and Jumbo types, and Bangladesh and India for the smaller Hallmark and Nipper types is seeing packers in the Victorian Wimmera pay around $810/t for the former and $775/t for the latter.

ETG Horsham-based pulse trader Todd Krahe said the container outlook has brightened considerably, and was contributing to some welcome liquidity in the lentil market.

“Month on month we’re getting better container availability, but it’s still not back to pre-COVID levels,” Mr Krahe said.

The COVID supply-chain shock saw price hikes of up to US$500/t being imposed on 20-foot containers going from Australia to South Asia via transshipment ports.

Prices have now stabilised, and at levels well below their COVID peaks.

“Some shipping lines are quoting two months in advance, when we were down to one month before.

“That increase gives traders confidence to sell going forward, and that can now be out to June.”

Mr Krahe estimates around two-thirds of the total crop remains unpriced and on farm, and the stronger bids are attracting grower sales.

“We’re finding a lot of growers that hadn’t marketed any lentils are starting to bring samples in now.”

The earlier-maturing Mallee region of Victoria produced a reasonable proportion of second-grade lentils, the result of rain late in the growing season and into harvest.

These No. 2 lentils are trading at a discount of around $80/t to No. 1s.

Yields were generally excellent in both the Wimmera and Mallee, and in SA also.

Despite some downgrading in the Mallee, and weed issues caused by successive rain in the later-maturing Wimmera, Mr Krahe said growers looked likely to stick with a similar proportion of the pulse in their 2023-24 mix when planting gets under way from next month.

“I can’t see any reason for area to decline; especially in the Mallee, some growers had the best year they’ve ever had, and some were first-time growers.”

An IMF bail-out has allowed Sri Lanka to return as a bulk customer, along with Bangladesh, Egypt, India, Turkiye and the UAE, with both SA and Vic loading full or part cargoes.

Mungbeans

Speaking at the Summer Grains Conference on Qld’s Gold Coast last week, Mr Hunt, who is also the Australian Mungbean Association president, put the crop now being harvested at 60,000t.

An unusually dry December and January severely limited planting intentions in NSW and southern Qld, and after hopes for a big crop built over the wet spring, the ballpark average crop size of 100,000t looks well out of reach.

“Growers and everyone else had the assumption that it was going to keep raining; that’s not what happened,” Bean Growers Australia chief executive officer Lloyd Neilsen said.

“Most people expected a really substantial plant.”

Early-planted crops in NSW and southern Qld are now being harvested, but most of the mungbeans to hit the market this year will come from Central Qld.

“CQ got rain from a front in January, but growers generally are not wanting to do any forward selling.”

Buoyant demand from China has lifted the nominal price of No. 1 grade mungbeans to more than $1400/t delivered up-country packer, with processing at $1350/t and manufacturing $1250/t.

“Prices are up on demand out of China, and the lack of supply out of Australia.”

Those growers in northern NSW and southern Qld that did have enough subsoil moisture to plant generally went for big sorghum areas, with the price for the red grain strong, also based on demand from China.

Source: Grain Central